PH Resorts Group Holdings Inc, the gaming entity controlled by local billionaire Dennis Uy, has…

Non-gaming amenities that stand out from the crowd are becoming an increasingly important aspect of global IRs.

There is no doubt that the non-gaming amenities in today’s integrated resort projects have been consistently gaining more weight of capital spend on a global basis. And these non-gaming projects continue to get bigger, bolder and better. Whether it’s through sheer development size or diverse and dramatic elements, non-gaming amenities have evolved into something more than just a necessary evil and financial loss-centers for IRs. Super amenities have arrived – and they’re here to stay.

THE ARRIVAL OF “SUPER AMENITIES”

In December 2015, the Poarch Band of Creek Indians opened a US$246 million expansion of their Wetumpka, Alabama property, which included an iconic 360-degree aquarium at the facility’s center bar. In February 2018, Las Vegas Sands and the Madison Square Garden Co. announced plans to build the MSG Sphere – a 360-foot tall, 500-foot wide arena. In March 2018, the Pechanga Band of Luiseño Indians officially unveiled their US$300 million expansion that included a 4.5-acre pool complex, a two-level luxury spa and 40,000-square foot Pechanga Summit.

In Asia, in addition to the Golden Reel and Macau eStadium at Studio City, City of Dreams Manila just opened its new virtual reality (VR) game zone covering over 2,700-square meters on the upper ground floor of the resort, with close to 600-seat capacity. Additionally, South Korea’s Paradise City has recently completed the second stage of new non-gaming facilities including a high-end shopping mall, boutique hotel, film studio, family entertainment compound and art gallery.

While some of the first diversified gaming experiences relied on relatively “standard” amenities such as traditional food and beverage outlets and box-style meeting space, gaming properties can no longer rely on cookie-cutter non-gaming facilities. Industry professionals anticipate a wider variety of amenities to appear to seduce new customers and to keep older ones.

Now, both destination and regional gaming facilities are expanding their non-gaming offering to include unique amenities such as Topgolf, social bowling experiences and indoor waterparks among others. Properties considering any non-gaming expansion must now focus their development on differentiated offerings more than ever.

THE NON-GAMING GOLD STANDARD VS THE REST: INSIGHTS THROUGH JUXTAPOSITION

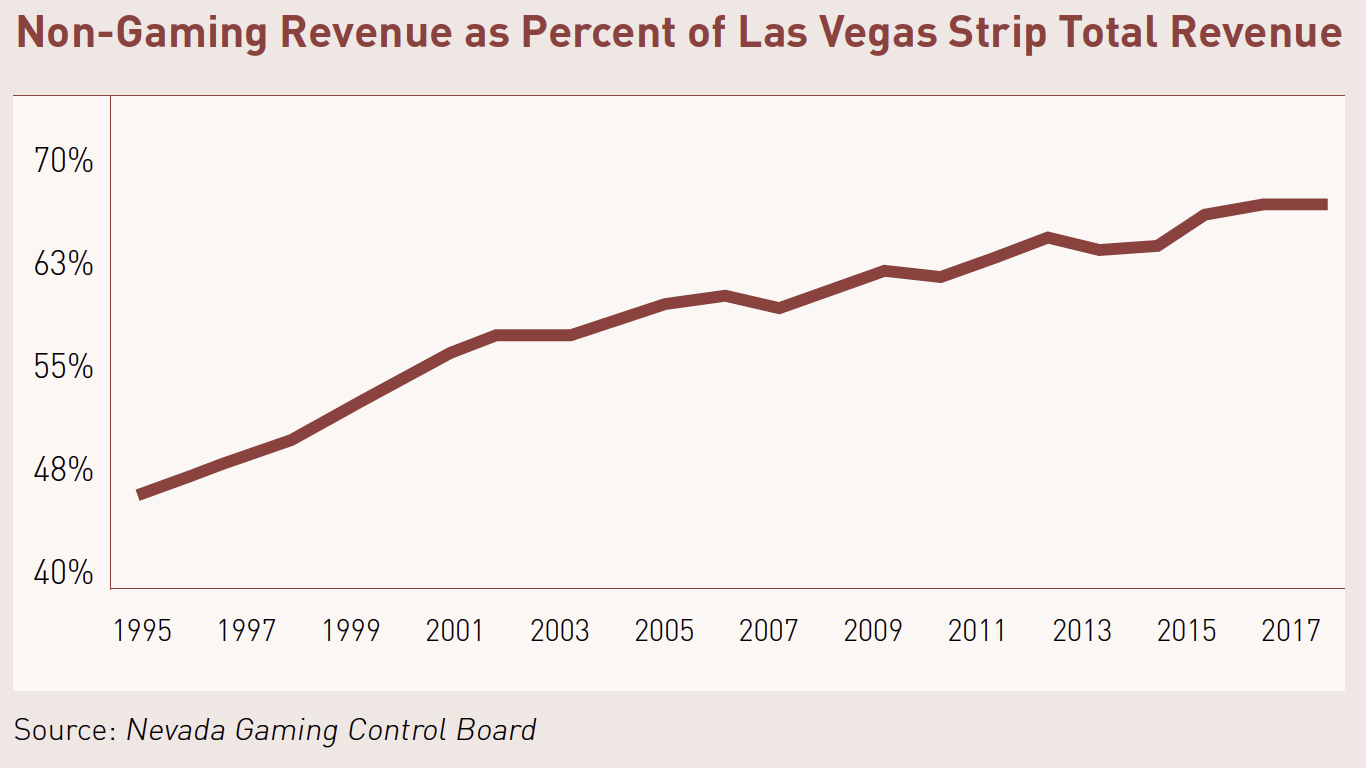

The chart over the page illustrates a fact that is nothing new in the gaming world – Las Vegas is the gold standard when it comes to non-gaming amenities and, perhaps, the global standard for the entertainment industry in general. Non-gaming revenue as a percentage of total Strip revenue reached an all-time high in 2017 at 66%. This comes as Strip properties continue to jockey for a larger share of the seemingly ever-increasing flow of visitors to the destination – visitors who are seeking a one-of-a-kind experience that often involves minimal time spent on the gaming floor, if any.

From eSports arenas to social bowling venues, Las Vegas integrated resorts continue to reinvent themselves from a non-gaming perspective. Recognizing the revenue split of non-gaming to gaming, the focus on non-gaming innovation is justified. In terms of absolute floor space, gaming floors undoubtedly continue to shrink within integrated resorts, from already miniscule levels – now frequently less than 5% of total gross floor area.

Throughout its history, Las Vegas has transformed itself from the epicenter of gaming to the epicenter of entertainment. Is Vegas’s transformation a sign of things to come for gaming markets throughout the rest of the US and the globe?

Recognizing that gaming revenue will be the main driver for the top lines of regional properties for the foreseeable future, how then can these properties learn from the Vegas bellwethers and other regional players?

Recognizing that gaming revenue will be the main driver for the top lines of regional properties for the foreseeable future, how then can these properties learn from the Vegas bellwethers and other regional players?

Examining completed and announced non-gaming amenity developments over the past several years from forward-looking developers and operators reveals key considerations for future non-gaming development.

ESPORTS AND VR

In response to the ever-growing popularity of eSports in Asia, Melco Resorts & Entertainment opened the Macau eStadium at Studio City this summer. Other than hosting major multi-player eSports tournaments and promoting live-streaming of eSports events taking place outside Macau, the venue will also be equipped with more rooms where eSports training and other activities can be held. To take it even further, it is reported that Melco’s development effort in Japan will involve the integration of an eSports stadium into a future casino resort in the country.

Studio City is also set to feature the largest virtual reality (VR) zone in Asia for the 2019 Chinese New Year, with fantastic entertainment and cutting-edge technology to allow for a whole new experience, whereas it sister property, City of Dreams Manila, has just opened a similar game zone.

In the US, from eSports arenas to arcades to diverse pool concepts, IRs are increasingly looking to draw new customers from outside of the Baby Boomer demographic and are doing so with amenity concepts of novelty. The rise of eSports-oriented amenities is a clear trend targeting the much-discussed and elusive (to gaming floors) millennial customer segment.

This bet on eSports appears to be warranted. A 2017 study completed by Limelight Networks found that 22% of American millennials polled say they regularly watch competitive gaming and that males between the ages of 18 and 25 in the US say they prefer eSports over traditional sports. Luxor’s eSports Arena Las Vegas is one of the recent eSports-only developments. With a space of more than 3,000 square meters, the arena represents one of the many new faces of non-gaming for IRs. Las Vegas represents perhaps one of the best environments for eSports as the city welcomes over 40 million visitors per year.

No matter the location, many gaming properties need to focus on customer segments outside of their core gamer to thrive. Providing an atmosphere that pleases a diverse set of patrons is key to expanding a property’s customer base.

FAMILY

While the millennial customer segment may not be available as a target customer for regional gaming properties, one demographic group that is available to many gaming properties is the family. More and more gaming properties are introducing family-oriented amenities, offering a one-stop entertainment destination for the entire family.

For example, some operators are reinventing the pool to attract a diverse group of customers to their properties. The pool amenity is often built to capture one of two seemingly opposite customer segments: the younger patron traveling to the resort in search of fun and entertainment, or the older patron visiting the resort, perhaps with a family, in search of rest and relaxation. To capture one of these two segments, many properties have historically created an atmosphere that caters to only one – the pool party atmosphere to capture the younger demographic or the spa-style pool to capture the older demographic.

More recently, however, properties are creating pool areas that offer value to a diverse set of patrons. One such example is “The Cove”, the 4.5-acre pool area that was part of Pechanga’s recently completed US$300 million expansion project at the Southern California IR. With multiple, segmented areas that cater to each of the distinct guest segments, the new pool retains not only families and millennial party guests, but also those non-participating guests who just want to watch the party pool.

An important caveat to consider as properties look to expand their customer base with non-gaming amenities – especially through the targeting of families: don’t forget about your core customer. Experts stress that creating an overall theme for a casino resort that strays too far from the core gaming customer can be a fatal flaw.

REGIONAL PROPERTIES MUST GIVE OUTER MARKET VISITORS A COMPELLING REASON TO VISIT

When targeting customers from outer markets, it’s imperative for regional and local gaming properties to offer a compelling reason to visit. As many of these properties compete with metropolitan areas that can provide a diverse set of leisure and entertainment offerings, gaming properties often must provide something more than a steakhouse and mediocre entertainment to entice outer market visitors to make the one to two-hour drive to their properties.

Continuing to innovate and positioning themselves as one-stop shops for entertainment is crucial for regional casino properties to capture and retain outer market visitors. For gaming customers, more amenities mean more to do and more reasons for a visit. The Pala Casino Spa & Resort in North San Diego County, California, introduced a wine cave in recent years. This is a fitting additional non-gaming amenity as the greater area seeks to position itself as a “wine country” destination similar to that in Northern California.

From an entertainment perspective, attracting and securing a diverse set of entertainers (and at the right cost) can be a major differentiating factor for regional gaming properties, even if they’re competing with urban centers. After all, there are few city-center destinations that can offer dinner from a high-quality restaurant, a show from a well-known entertainer, a potential night-cap on the gaming floor and a hotel to spend the night in, all under one roof. Not only can regional casino resorts offer a diverse set of amenities to patrons, they can also offer them to potential entertainers.

“SUPER AMENITIES” COME IN ALL SHAPES AND SIZES

Don’t be fooled by the term “Super amenity”. Super amenities don’t have to be super in size, although they often are. Unsurprisingly, the largest of the super amenities can be found in Las Vegas. Besides the aforementioned wine country in Southern California, the new Ocean Resort Casino in Atlantic City seeks to capitalize on the growing popularity of Topgolf without the space required of a full-scale Topgolf range. The resort will offer the world’s largest Topgolf Swing Suite, which will include 11 golf-simulator bays. At less than 30,000 square feet, the amenity is still large but significantly smaller in scale than a full-fledged Topgolf range.

Elsewhere, there has been a trend of introducing “food hall” food and beverage concepts at regional gaming properties. From an operator’s perspective, these offer an attractive speed of service, allowing gamers to return to the casino floor quickly, and a similar footprint to quick service food courts. From a patron’s perspective, these concepts offer a diverse set of higher quality food offerings – from wood fired pizza to specialty ethnic cuisine to specialty cocktails.

ARE “SUPER AMENITIES” SUPER INVESTMENTS?

Super amenities may draw press coverage and attract a new type of customer to gaming properties, but are they financially viable? Perhaps more importantly, does it matter if they represent financially attractive investments on paper?

It is true that these so-called super amenities may not be for every property. Some research suggests that building a parking garage shows the highest return on investment for gaming properties, so our recommendation has always been to build the amenities with the greatest return on investment first. Then, the focus can be switched to other things that may be desired but are less profitable.

While a successfully operated hotel project at a casino resort, for example, will generally have a payback period of three to five years, it may take developers of more atypical super amenities longer to recoup their investments. However, anecdotal evidence suggests that some resort elements in this new class of amenities, such as movie theaters and tech-infused golf ranges (with capital costs ranging from roughly US$5 million to US$50 million), provide very strong financial returns.

Given the small sample sizes, it remains to be seen whether the success will translate from market-to-market and it is a rigorous financial debate. In the end, it may not be possible to completely quantify the ROI on something that creates an iconic definition for an IR that is used in multitudes of ways to embody its brand.

The Bellagio celebrated its 20th anniversary in October. The fountains at the world-renowned property have been running for many years, but the sidewalk is still packed with onlookers when the fountain show starts. The emphasis on non-gaming amenities at Bellagio hasn’t dampened the property’s profitability at all. In the first six months of 2018, according to MGM Resorts International’s earnings reports, Bellagio had the third-best occupancy rate in Las Vegas at 94.5%, but the highest average daily room rate at US$283 and the highest revenue per available room at US$268. Globally, Bellagio had the highest six-month operating income among MGM properties at US$222.2 million and the second-highest cash flow, US$267 million, behind MGM China in Macau.

Mike Vanaskie and Michael Zhu, The Innovation Group)